Why Do I Need a Federal Employer Identification Number?

How It Works?

Different Ways to Apply for Federal Employer Identification Number.

Online

If you have SSN and know how to fill out an SS4 form you can obtain EIN in just ten minutes through the Internal Revenue Service website.

Fax

You have to fill out an SS4 form and fax it to IRS at this number 855-641-6935. In a few business days, Internal Revenue Service will return the fax with EIN.

If you choose to send your filled SS4 form through mail IRS takes a few weeks from the day they receive your application to provide you EIN.

Excellent services.

My experience with this company is so good their customer support, and customer handling is so satisfactory. Excellent services for company formation in USA.

M. Tayyab

Founder – Advance MedX

Simple Pricing

Simply order the service you want to use, we will ask you for addtional information about your business to fill SS4 form.

FAQ’s About EIN / Tax ID

No! federal employer identification number does not expire and can not be canceled.

The federal employer identification number is also known as FEIN, EIN, federal tax ID, and business tax id. This number is issued by Internal Revenue Service (IRS) to businesses to identify your company on federal filings.

Yes! every bank in the U.S. requires you to present your employer identification number along with company incorporation documents e.g. Article of Organization, Certificate of Incorporation and Operating Agreement to open a bank account.

No! EIN does not change unless you ask IRS to provide you with a new EIN if your business circumstances require it.

- A business is purchased by an individual who will operate it as a sole proprietorship / DBA.

- A business is inherited by an individual who will operate it as a sole proprietorship / DBA.

- Sole proprietorship status changed to LLC, Profit Corporation, or Partnership.

- Partnership status changed to LLC, Profit Corporation, or Sole Proprietorship.

- Profit Corporation status changed to LLC, Partnership, or Sole Proprietorship.

- LLC status changed to Profit Corporation, Partnership, or Sole Proprietorship.

- Individual owner dies, and the state takes over the business.

If you are a U.S. resident and have a social security number (SSN) number you will receive your EIN within 1 business day. If you are a foreigner and do not have SSN you will receive your EIN in few business days.

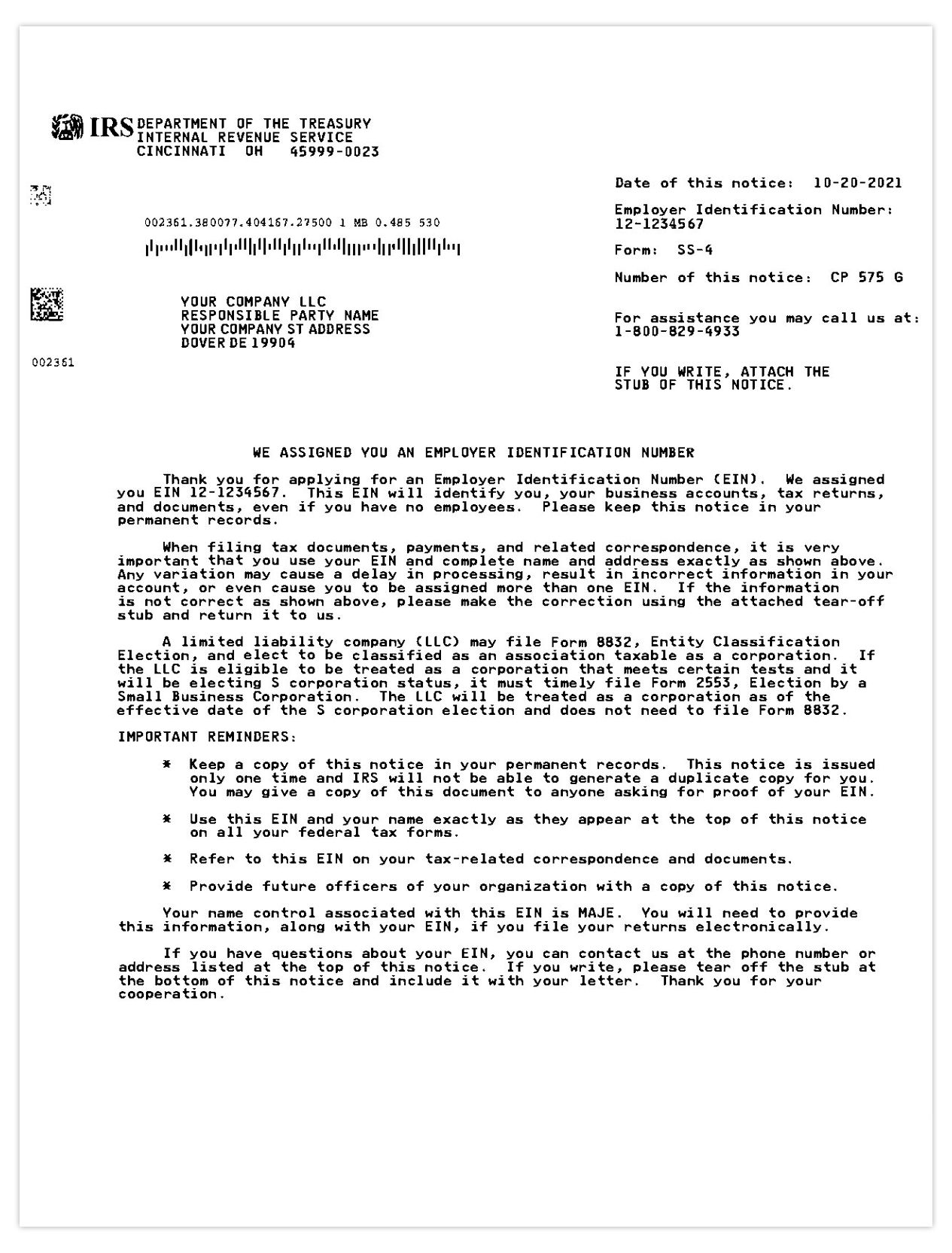

The SS4 form is a fillable PDF form that is provided by IRS to apply for an employer identification number through fax or direct mail.