Why Do I Need an Individual Tax Identification Number?

How It Works?

Different Ways to Apply for Individual Tax Identification Number.

Certified Acceptance Agent

The easiest way to get an Individual Tax Identification Number is to ask IRS Certified Acceptance Agent to help you. With CAA’s help, you don’t have to fill out complex tax forms and get your ID notarized, CAA does all for you.

Acceptance Agent

The only difference between IRS Acceptance Agent and IRS Certified Acceptance Agent is you have to get your ID notarized by a person/business whose notarized documents are accepted by IRS. A CAA can do it for you and CA can not.

Yourself

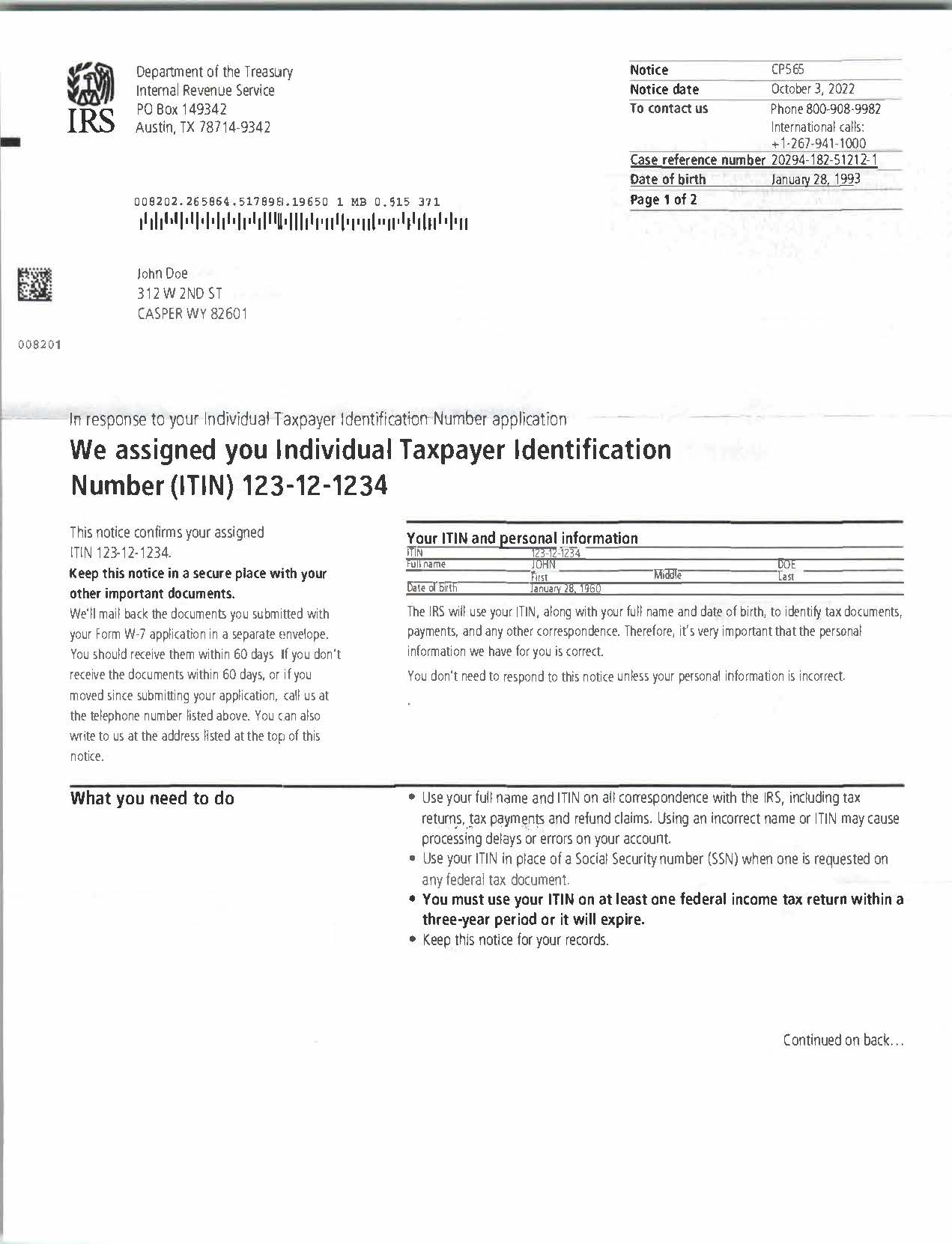

If you are planning to file an Individual Tax Identification Number application yourself. You will have to fill out form W-7 and form 1040 and attach your ID, get it notarized by a public notary, and mail it to IRS. If you make even a tiny mistake IRS may not issue you the ITIN.

Excellent services.

My experience with this company is so good their customer support, and customer handling is so satisfactory. Excellent services for company formation in USA.

M. Tayyab

Founder – Advance MedX

Simple Pricing

Simply order the service you want to use, and we will schedule the video meeting with one of our Certified Acceptance Agents to verify/notarize your ID and fill out the W7 application along with additional required forms.